Understanding the Latest Inflation Trends: A 2.4% Rise in March

BlogTable of Contents

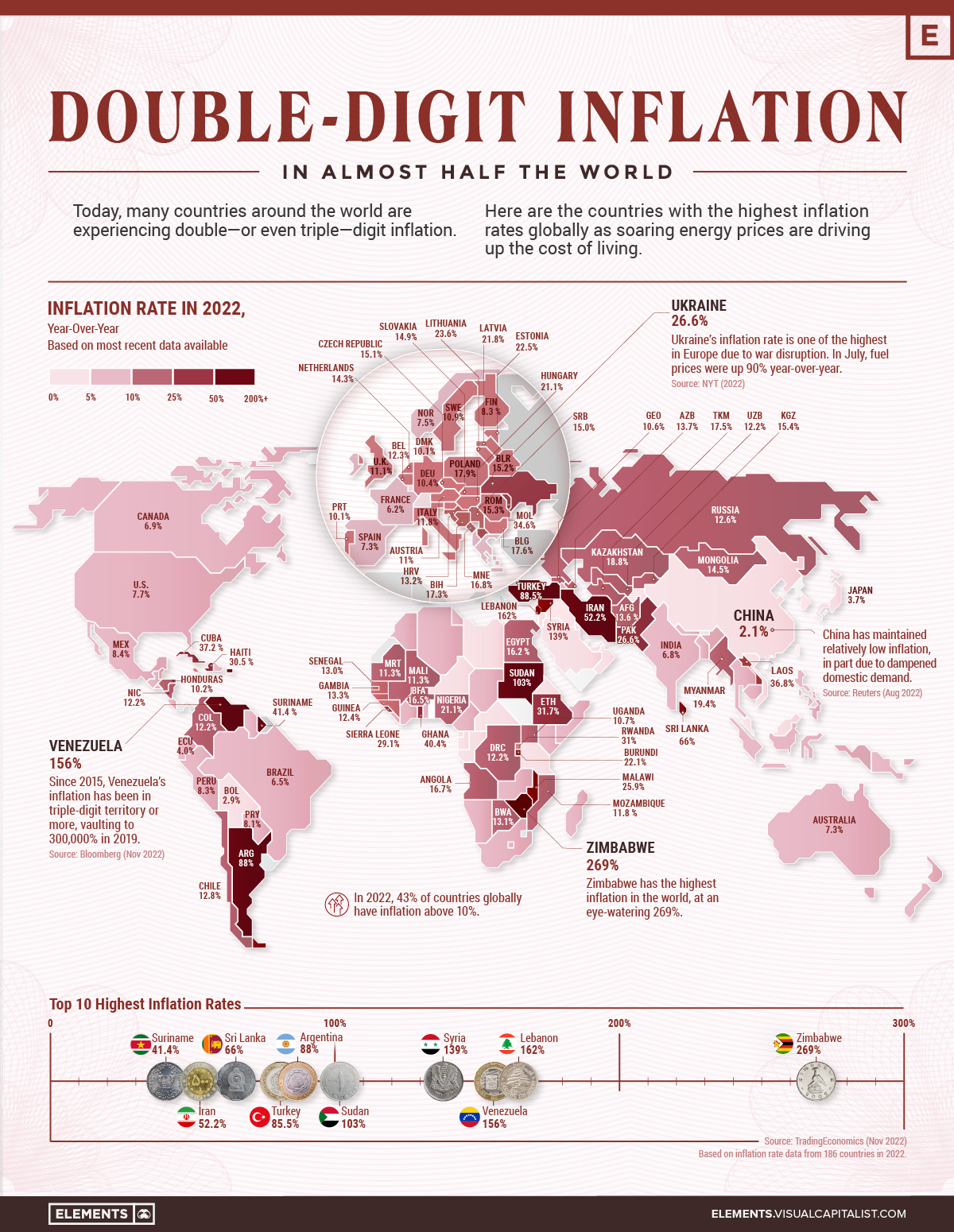

- Inflation By Country 2025 - Marin Sephira

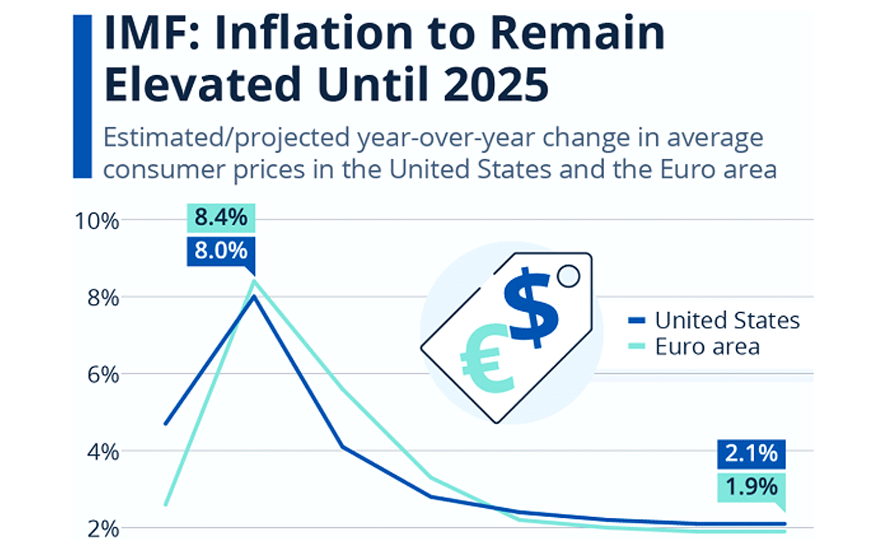

- IMF: Inflation to Remain Elevated Until 2025 – Ahead of the Herd

- Inflation Relief Program October 2025 Ny - Cameron Baker

- Le Bureau du Plan prévoit une inflation de 2,5% pour 2025 - RTBF Actus

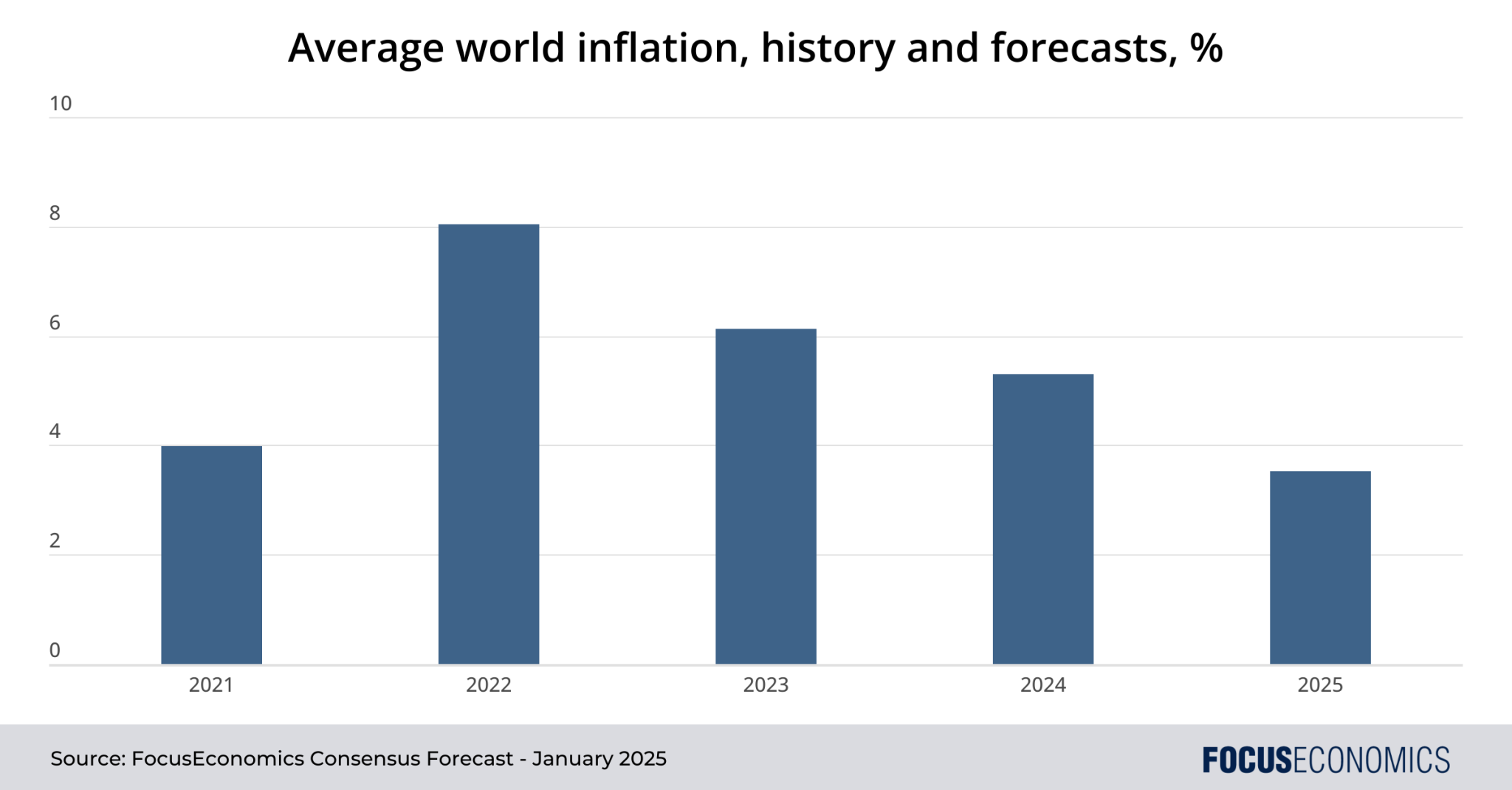

- Kemenkeu proyeksikan inflasi global 5,2 persen pada 2024 - ANTARA News

- Indonesia inflation staying above 5% in first half of 2023: Central bank

- Inflasi Januari 2023 Menurun · Ninna.id

- Global Inflation Rates in 2025: What to Expect

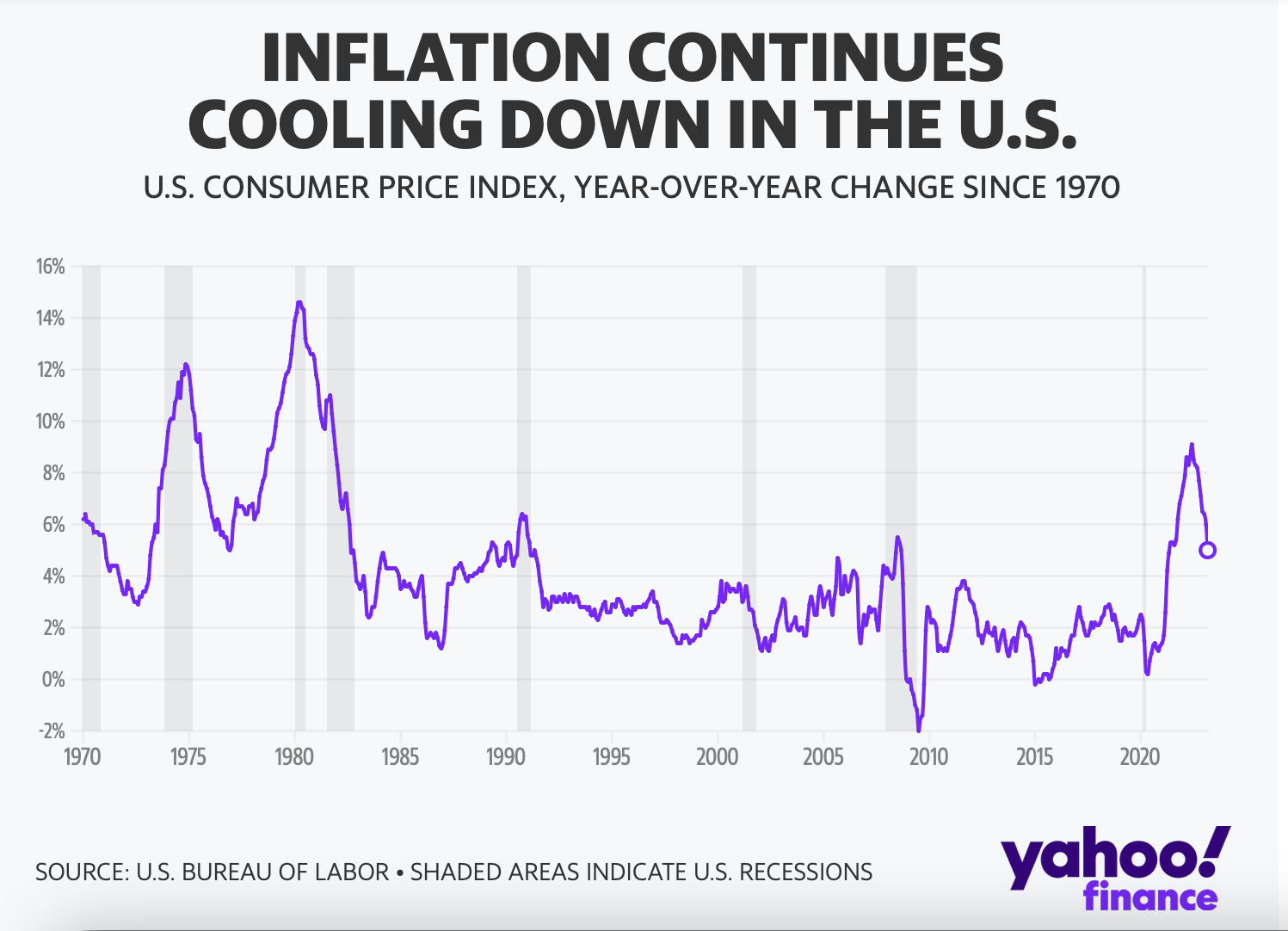

- Inflasi AS Melandai ke 5 Persen per Maret 2023, Imbasnya ke Suku Bunga ...

- Global Inflation Rates in 2025: What to Expect

What is the Consumer Price Index (CPI)?

Key Findings from the March CPI Report

What Does This Mean for Consumers?

The 2.4% increase in inflation may have a noticeable impact on household budgets. As prices rise, the purchasing power of consumers is reduced, making it more expensive to buy everyday essentials. This could lead to: Reduced consumer spending: As prices increase, consumers may cut back on discretionary spending, which could affect businesses that rely on consumer demand. Higher interest rates: To combat inflation, central banks may raise interest rates, making borrowing more expensive and potentially slowing down economic growth.

Implications for Businesses and the Economy

The rise in inflation also has significant implications for businesses and the overall economy. Companies may face: Increased production costs: Higher input prices, such as raw materials and labor, could squeeze profit margins and lead to higher prices for consumers. Reduced demand: As consumers reduce their spending, businesses may experience decreased sales and revenue. On the other hand, a moderate level of inflation can also have positive effects, such as: Stimulating economic growth: A small amount of inflation can encourage spending and investment, as consumers and businesses are incentivized to make purchases before prices rise further. The 2.4% rise in inflation in March, as reported by the CPI, is a significant development that warrants attention from consumers, businesses, and policymakers. While inflation can have negative effects, such as reduced purchasing power and higher interest rates, it can also stimulate economic growth. As the economy continues to evolve, it's essential to monitor inflation trends and adjust strategies accordingly. By understanding the causes and implications of inflation, we can better navigate the complex economic landscape and make informed decisions about our financial futures.Stay ahead of the curve and stay informed about the latest economic trends and insights. Follow our blog for regular updates and analysis on the world of finance and economics.