Understanding the Social Security Tax Limit: A Guide to Retirement Planning

BlogTable of Contents

- Which States Tax Social Security in 2024 - YouTube

- 40 Credits & Social Security in 2024 With the New Rules - YouTube

- 8,600 - New Social Security Maximum Taxable Earnings in 2024 - YouTube

- Social Security Is INCREASING in 2024… Here’s the Exact AMOUNT 3.1% ...

- 0 Increase for Social Security in January 2024 – Who is Eligible for ...

- Fica And Medicare Withholding Rates For 2024 Withholding - Nani Tamara

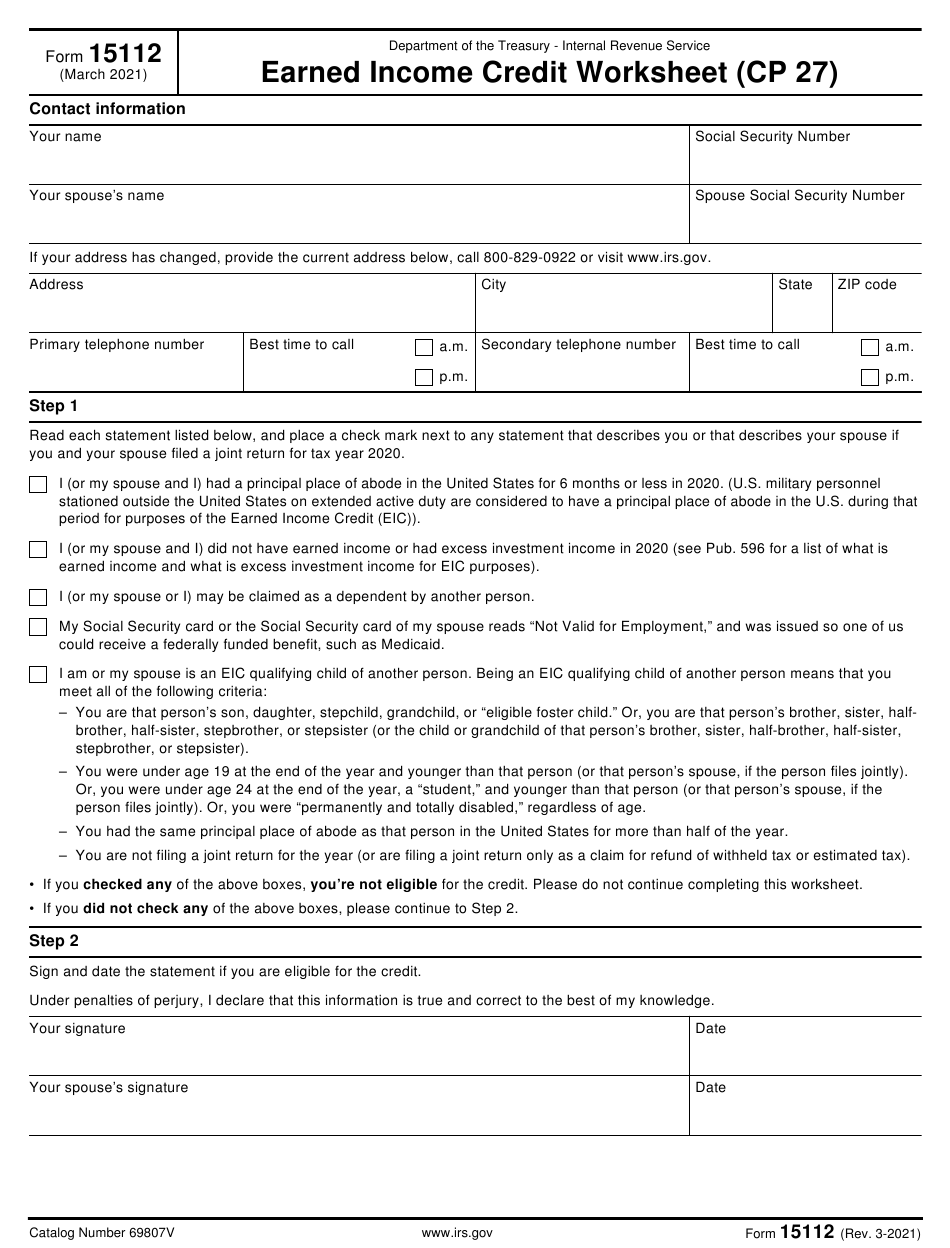

- Social Security Withholding 2024 Form - Heidi Kristel

- Social Security 2024 Trustees Report | SSA

- Today! Confirmed Adjustments to Social Security and Medicare for 2024 ...

- Social Security RAISES & TAXES! Here’s What Congress Just Said - SSI ...

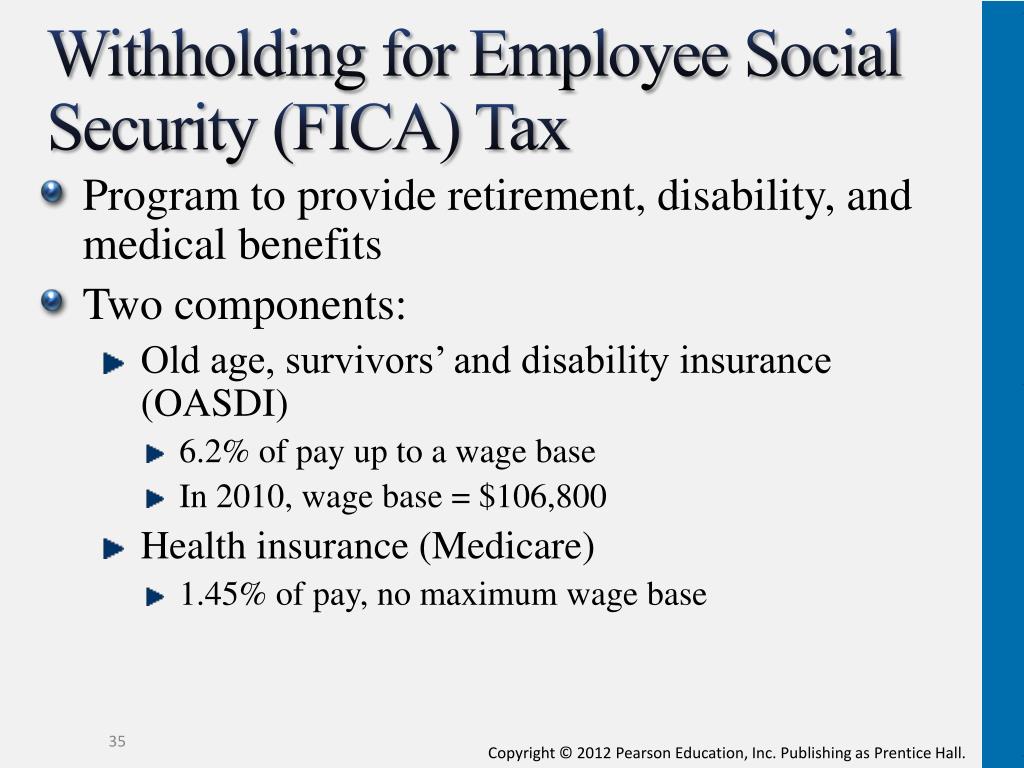

What is the Social Security Tax Limit?

How Does the Social Security Tax Limit Affect Retirement Planning?

Who is Affected by the Social Security Tax Limit?

The Social Security tax limit affects high-income earners who exceed the tax limit. According to the Social Security Administration, about 6% of workers earn above the tax limit. These individuals will not have to pay Social Security taxes on their excess earnings, but they will also not earn additional Social Security credits.

Retirement Planning Strategies

Understanding the Social Security tax limit is essential for retirement planning. Here are some strategies that individuals can use to maximize their retirement benefits: Maximize earnings below the tax limit: Individuals should aim to maximize their earnings below the tax limit to earn as many Social Security credits as possible. Consider alternative retirement plans: High-income earners may want to consider alternative retirement plans, such as 401(k) or IRA plans, to supplement their Social Security benefits. Consult a financial advisor: Individuals should consult a financial advisor to determine the best retirement planning strategy based on their individual circumstances. In conclusion, understanding the Social Security tax limit is crucial for retirement planning. The tax limit affects high-income earners who exceed the limit, and it has significant implications for their Social Security benefits. By maximizing earnings below the tax limit, considering alternative retirement plans, and consulting a financial advisor, individuals can make informed decisions about their financial future. Whether you are a high-income earner or just starting to plan for retirement, it is essential to understand the Social Security tax limit and how it affects your retirement planning.For more information on the Social Security tax limit and retirement planning, visit the Social Security Administration website or consult a financial advisor.